![]()

Clorox sells a variety of consumer staples products, including cleaning supplies, laundry detergents, trash bags, cat litter, charcoal, food dressings, water-filtration products, and natural personal-care products.

Clorox has tremendous brand strength. More than 80 percent of the company’s sales are generated from brands that hold the number 1 or 2 market share positions in their categories.

SWOT Analysis

Strengths

Clorox has significant competitive advantages including strong brands, economies of scale, outstanding management, an adapting product line, and barriers to entry. Economies of scale allow Clorox to keep margins above average. Profitable long term relationships with retailers translates into loyalty and prime shelf space that makes it harder for competitors to grab market share.

Weaknesses

The household and personal products industries are mature markets with a great deal of competition. Low growth rates make it difficult to grow earnings without adding new products through innovation or acquisition.

Nearly 50% of Clorox business is derived from five retailers including approximately 25% coming from Wal-Mart alone. This means the company has limited pricing power because retailers are squeezing suppliers for lower prices in this competitive environment.

Opportunities

Clorox is bringing new products to market that are considered value-added as well as extensions to current product lines. New Bert’s Bees Face and Body products, Control Bleach Crystals, Pump N’ Clean Products, Light Weight Charcoal, OderShield and Force Flex bags, ScrubSingles, Triple Action Dust Wipes, Urine Remover, and Clorox Pool Products are examples of how Clorox is using opportunities to grow revenues.

Acquisitions provide additional sales channels that while still remaining true to their core businesses. The objective is to invest in markets that provide higher growth potential.

Threats

A major threat is private label growth as retail customers become more savvy shoppers and price conscious. The competitive environment allows for retailers to ask for lower prices and consumers to trade down to cheaper alternatives.

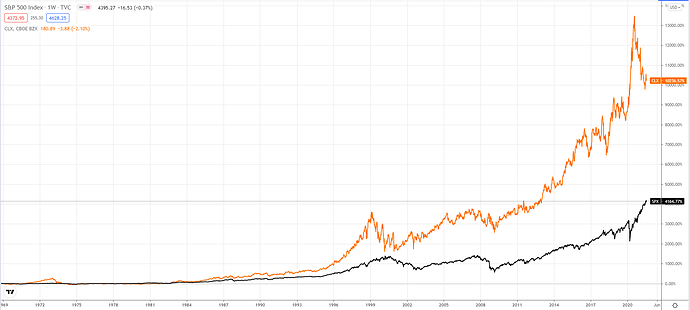

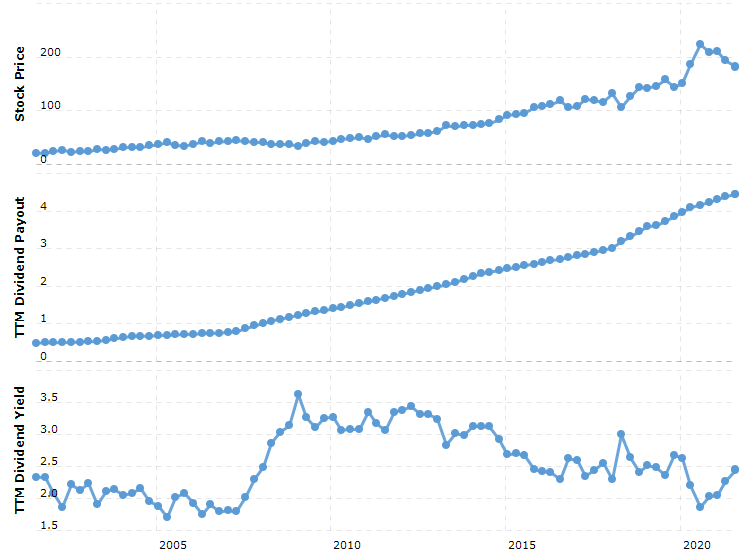

Histórico:

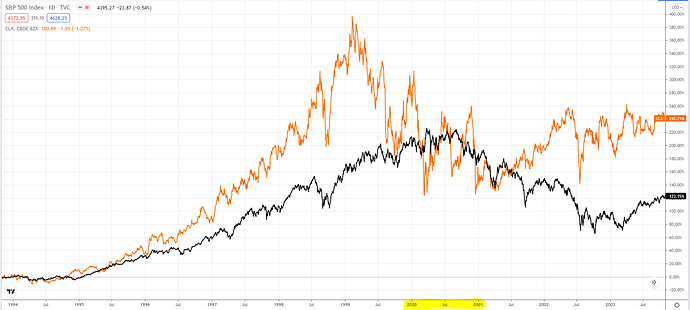

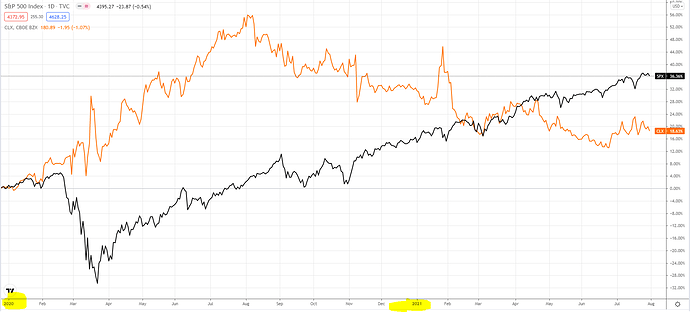

Tech bubble:

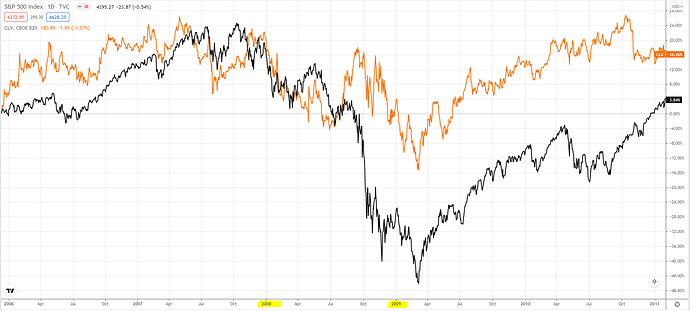

Crise de 2008:

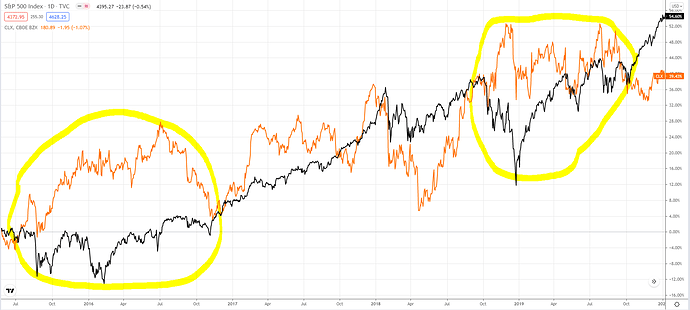

Descorrelação com o S&P500 no geral:

Pandemia 2020 (produtos de higiene doméstica “bombaram” no auge da crise):

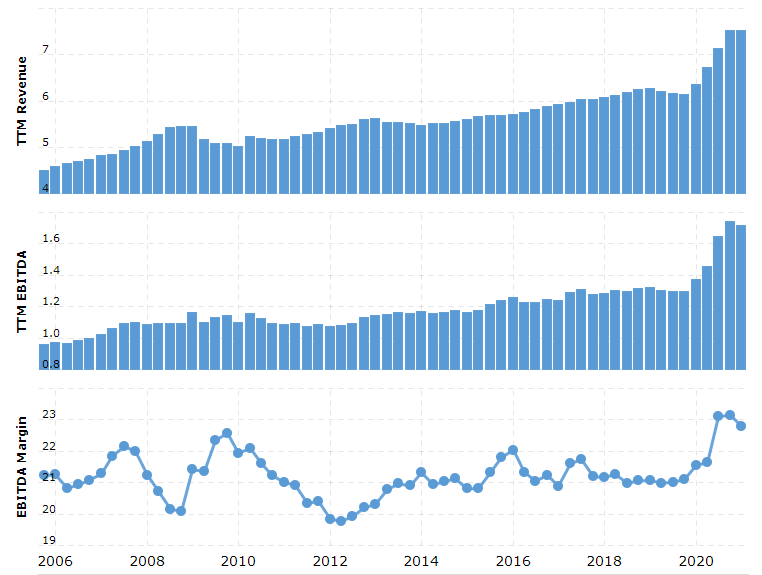

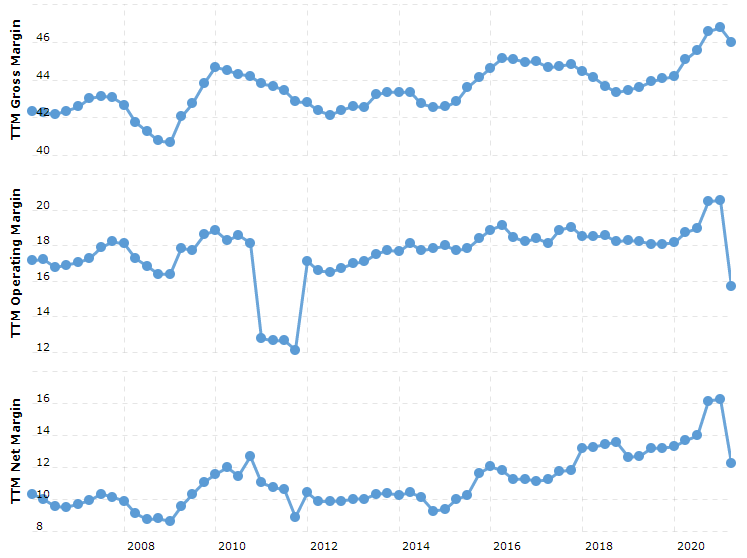

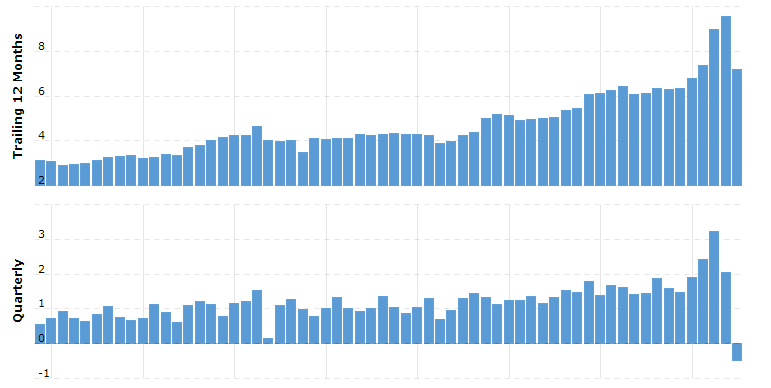

EPS:

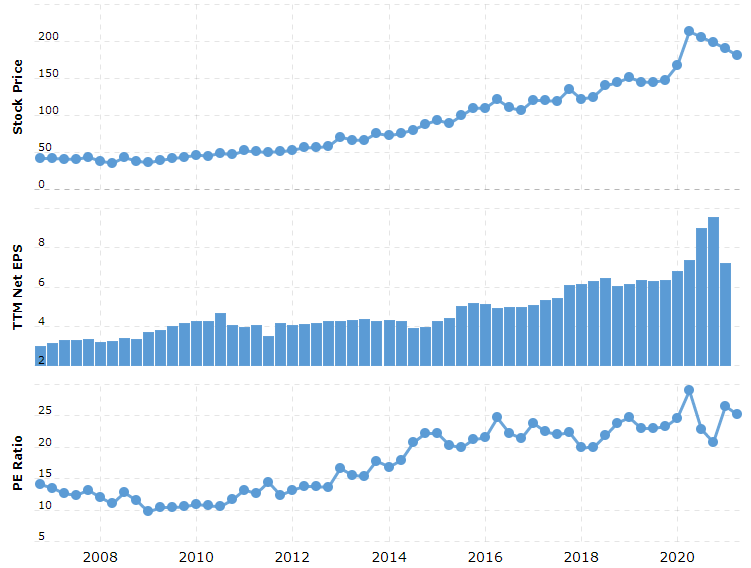

PE:

Resumo:

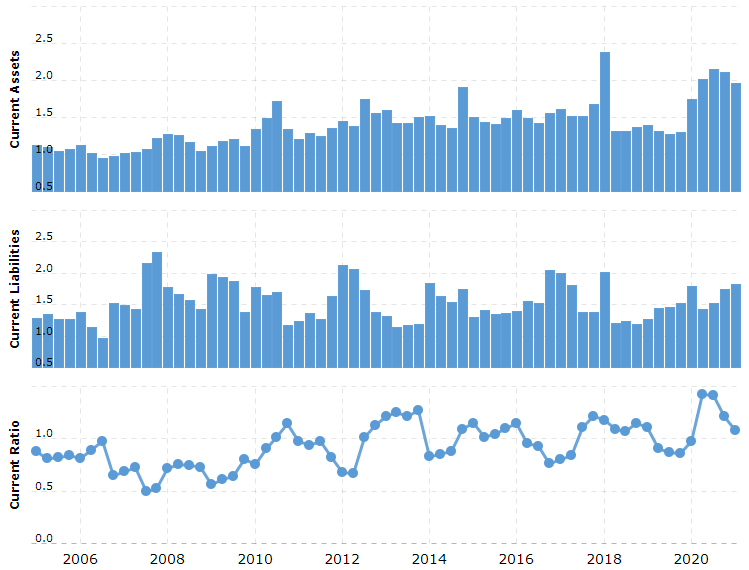

- Atua num setor altamente defensivo, com produtos de necessidade básica, gerando boa descorrelação com a “bolsa em si”.

- Boa parte dos produtos é líder, ou segundo lugar, em vendas.

- Empresa com longo histórico de crescimento e pagamento de dividendos.

(Sim… é o mesmo resumo de CHD ![]() )

)

Junto com Hormel é a parte mais defensiva da minha carteira de investimentos no exterior.